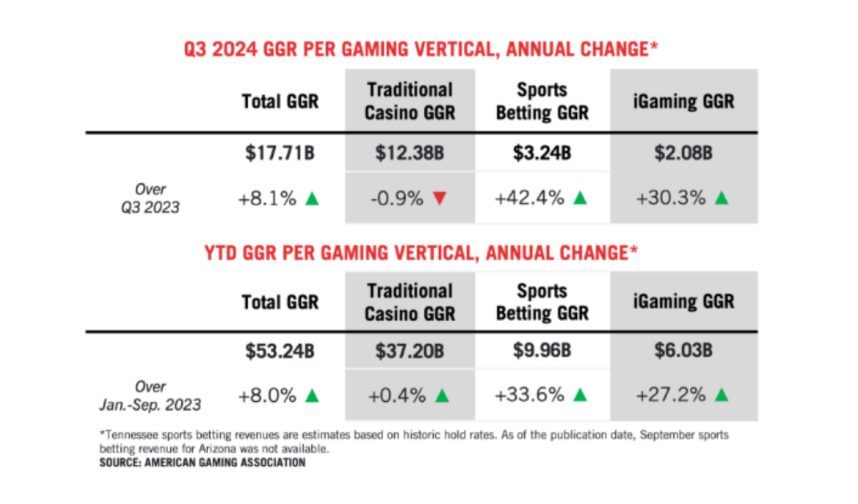

In the third quarter of the year, commercial gaming revenue hit $17.71 billion, driven by the growth of sports betting and iGaming sectors.

On Thursday, the American Gaming Association (AGA) announced that gamblers lost a record amount of money from July to September. The $17.71 billion indicated an 8.1% rise compared to the previous year. Q3 also signified the gaming industry's 15th straight quarter of year-over-year expansion.

That's the positive aspect. Now, the negative.

Even though overall gaming revenue kept increasing, the situation wasn't as favorable for traditional gaming interests or physical gaming establishments. The AGA report showed that in-person gambling revenue at casinos decreased by nearly 1% to $12.38 billion.

“Traditional brick-and-mortar casino gaming revenue contracted annually by less than 1% in the third quarter, with slot machines and table games generating $12.38 billion in revenue. Brick-and-mortar revenue decreased year over year in two of the three months in Q3, only rising in August,” the AGA summary read.

Table games contributed to the decrease in legacy, while slot winnings increased by 1.3% to reach $9.1 billion. The national table hold was only 20%, marking the fourth consecutive quarterly decrease. Felt GGR decreased by 8.3% in the quarter to reach $2.42 billion.

The other $860 million in legacy revenue was generated by retail sportsbooks, poker rooms, and various casino games such as bingo.

iGaming, Expansion of Online Sports Wagering

Retail casino losses at the tables were effortlessly balanced out online, as internet casinos and mobile sportsbooks experienced ongoing revenue growth.

Over the course of three months, regulated online casino gaming in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia surged by 30% to reach $2.08 billion. Sportsbook earnings reached $3.24 billion, a 42% increase compared to Q3 of the previous year.

Over three quarters, iGaming earnings in only seven states surpassed $6 billion, marking a 27.2% increase. That represents 16.2% of the $37.2 billion earned by physical casinos in 27 states with commercial gaming. Rhode Island was the seventh state to adopt iGaming, launching its Bally’s Casino online platform in March.

"Each of the six iGaming states with 2023 comparisons grew year over year in the third quarter, led by 393% growth in Delaware powered by the Delaware Lottery’s new iGaming partner Rush Street Interactive. Each of the other five pre-existing iGaming markets posted annualized quarterly growth of 25-68%,” the AGA said.

In the past nine months, sports bettors have incurred losses of $9.96 billion, which is 33.6% higher than the losses recorded at the same time last year. The $9.96 billion sets a fresh revenue record for sports betting in the third quarter, as the market stabilizes following the absence of new state launches for sports betting this year.

Missouri is anticipated to become the 39th state with legalized sports gambling next year, as state voters endorsed sports betting via a statewide ballot referendum in the November 5 election.

Market Forecast

With nine months completed for 2024, every commercial gaming segment is showing positive growth, as traditional casino GGR is up 0.4% even in light of a challenging third quarter. Despite some Americans reducing their leisure expenditures due to ongoing inflation that keeps everyday goods expensive, the gaming sector continues to thrive.

“Through the first nine months of the year, nationwide commercial gaming revenue stands at $53.24 billion, pacing 8.0 percent ahead of 2023 and putting the industry on track for a fourth straight record revenue year,” the AGA concluded.