Fanatics, a relatively new entrant in the US sports betting arena, is gaining ground in New York — the nation’s biggest market by handle.

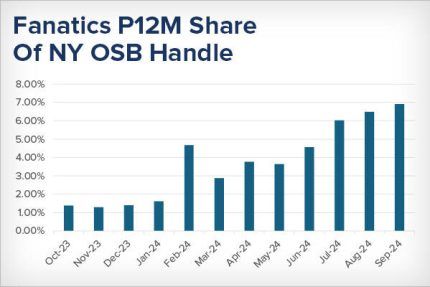

In 2023, privately owned Fanatics purchased PointsBet US for $225 million in an all-cash transaction, allowing the buyer to enter the regulated sports betting market. One year ago, PointsBet held slightly over 1% market share in New York according to handle, but that figure has increased notably in recent months.

"The Fanatics brand actually launched in March 2024, taking over from PointsBet and has since grown handle share from under 3% to just over 7% in the seven months since,” according to Eilers & Krejcik Gaming (EKG).

In September, Fanatics held the fifth position in the New York online sports betting market share, behind FanDuel, DraftKings, BetMGM, and Caesars Sportsbook.

Additional Indicators of Advancement for Fanatics in New York

Placing fifth in New York may not seem impressive, yet there are additional indicators of Fanatics' advancement in the fourth-largest state.

“Regardless, the general upward trend in New York and increasing marketing spend looks to be part of a national uptick,” added EKG. “Fanatics was fourth in online sports betting application download share through six weeks of NFL action, per Sensor Tower data, behind only FanDuel, DraftKings, and Hard Rock.”

The observations regarding mobile app downloads apply to the entire US, indicating that Fanatics is achieving gradual advancement in the highly competitive US sports betting market, which is primarily led by FanDuel and DraftKings. Fanatics provides mobile sports wagering in 22 states plus Washington, DC.

The operator's positive trend in New York follows Chairman and CEO Michael Rubin's statement two years prior that the company would probably forgo the state because of its 51% tax on sports betting, the highest nationwide.

Promotional Expenses Assisting Fanatics in New York

One reason Fanatics is gaining ground in New York is that it is demonstrating generosity with its promotional expenditures.

“The operator has been aggressive around bonusing in recent weeks, including a 10-day free bet challenge with up to $1,000 in bonus bets for new customers,” observed EKG.

Promotional expenses by sportsbooks typically increase during football season, as it is the most bet-on sport in the US. Nonetheless, advertising expenditures have declined in recent years as operators have prioritized profitability.

Fanatics' investments in that area in New York are significant and may yield benefits for customer acquisition, as several competitors have reduced their marketing budgets in the state to cope with the elevated taxes.